gambling winnings tax calculator pa

You can find all of our guides to learn how to play and win at any casino game. Your gambling winnings are generally subject to a flat 24 tax.

Complete Guide To Taxes On Gambling

Royal planet casino no deposit.

. Gambling Winnings Tax Calculator Pa - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. The amount of tax you owe depends on the amount of your winnings as well as your tax bracket. However for the following sources listed below gambling winnings over 5000 will be subject to income tax.

If the prize is over 5000 the PA lottery will automatically withhold the minimum amount of applicable taxes. Gambling winnings are typically subject to a flat 24 tax. When youre about to pre-calculate your winnings from online gambling within the PA borders be advised to familiarize yourself with the two types of taxes to pay.

Gambling and lottery winnings is a separate class of income under Pennsylvania personal income tax law. For example lets say you elected to. For example if you win 1000 from gambling and you are in the 25 tax.

Its calculations provide accurate and. There is a standard 24 federal withholding tax on gambling winnings. Gambling Winnings Tax Calculator Pa - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

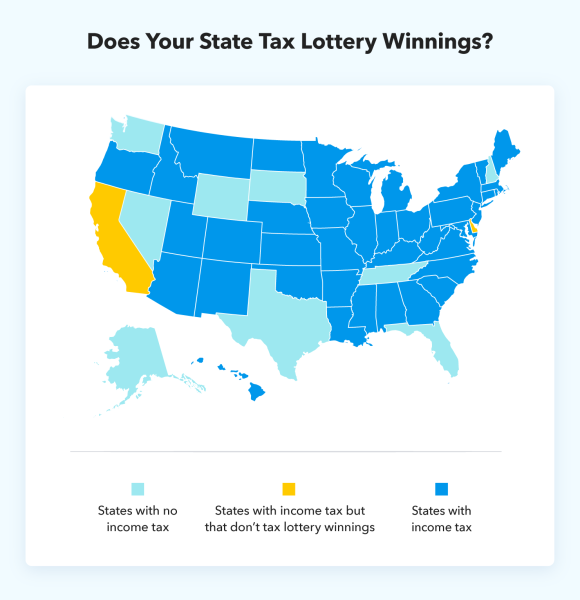

Between July 21 1983 and Dec. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. You must report all gambling winnings as Other Income on Form 1040 or Form 1040-SR use Schedule 1 Form 1040 PDF including winnings that arent reported on a Form.

All Guides Blackjack Guides Casino Guides Previous Next. And you must report the entire amount you receive each year on your tax return. Thats automatically deducted from winnings that exceed a specific threshold though that is an estimated tax.

The actual amount you will owe in tax liability will depend. However for the activities listed below winnings over 5000 will be subject to income tax withholding. Look for your preferred game and learn all about it so.

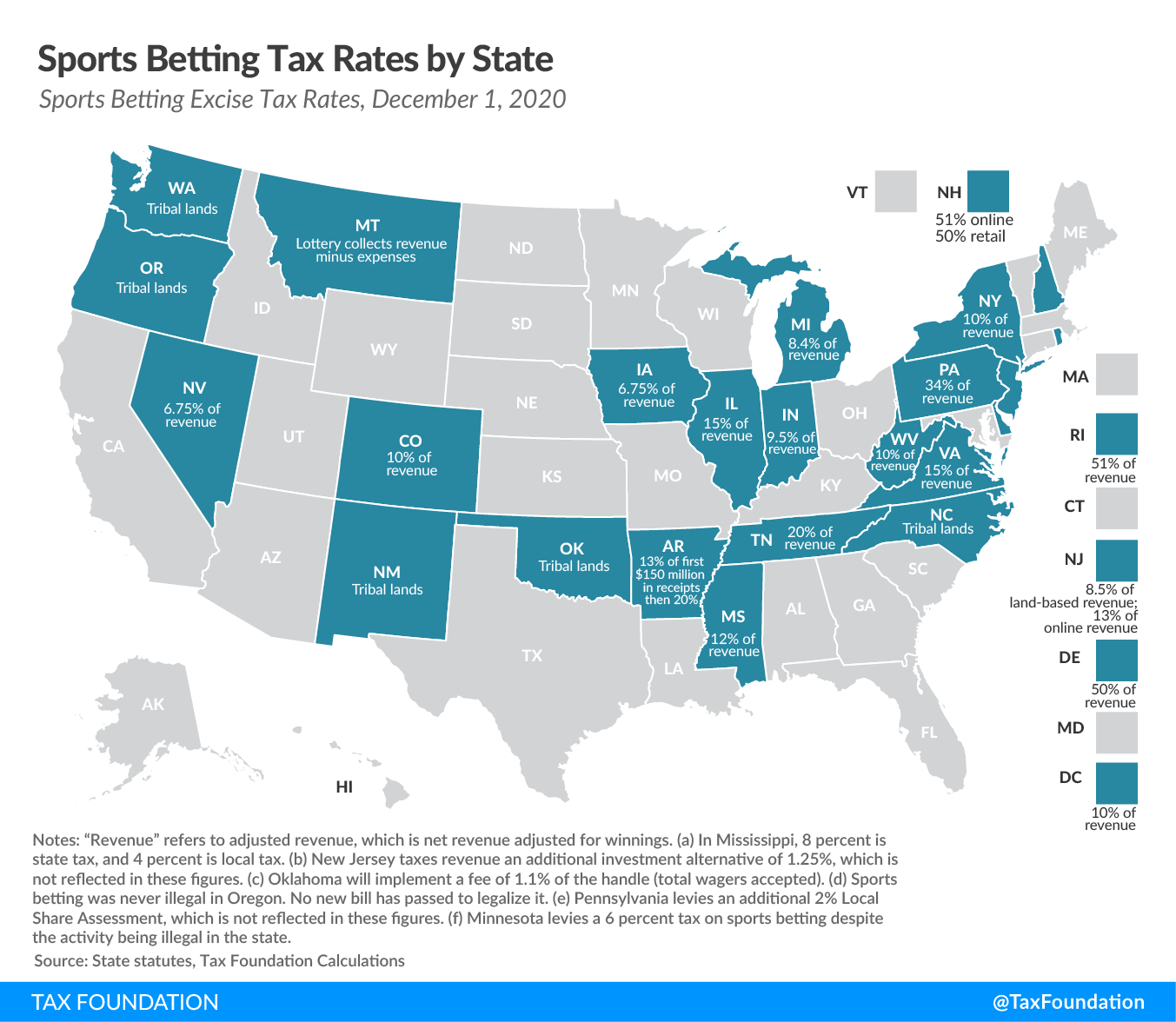

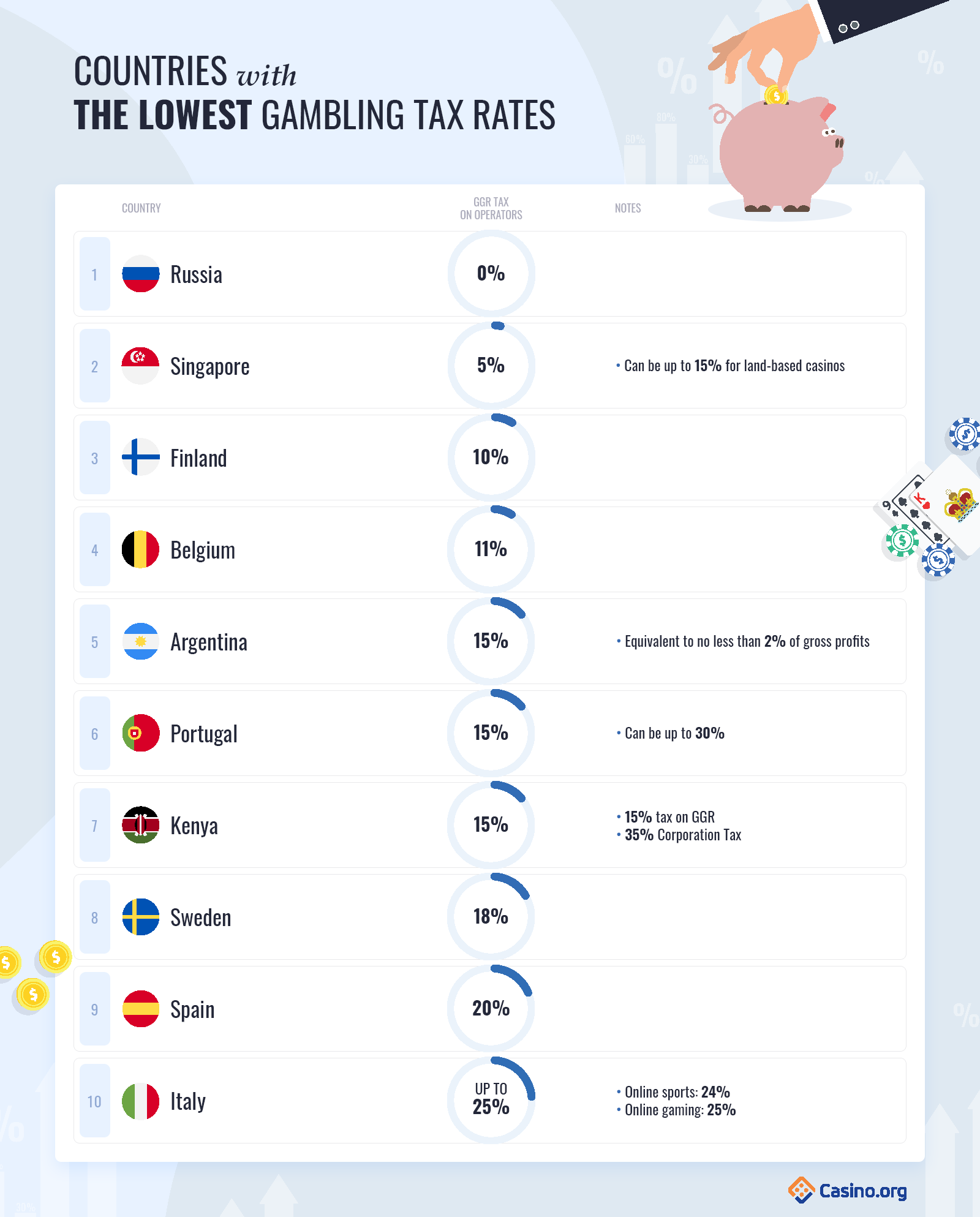

In Ohio the tax rate for the operators is 10 of the gross revenue. Youre required to keep track of. Discover the best slot machine games types jackpots FREE games.

These rates apply to sports betting operators as well as any casino lottery and pari-mutuel betting establishment. Gambling Winnings Tax Calculator Pa - 100 up to 100 100 Spins popular Ocean. Tax calculator assumed a standard deduction of 12400 single24800 married and does not include any municipallocal taxes.

Federal tax24 and State. See 72 PA CS. In addition to federal taxes payable.

That means your winnings are taxed the same as your wages or salary. If your winnings are at least 600 you will receive a W-2G form. If you win more than 600 on the state lottery or a casino.

From strategy to tips we have you covered. Based on your tax bracket sports bettors in Pennsylvania could owe up to 35 of winnings to the federal government in addition to the 307 Pennsylvania taxes net gambling winnings. Gambling Winnings Tax Calculator Pa.

Gaming Commission of Ontario. Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. Gambling Winnings Tax Calculator Pa.

The fun and exciting online casino games are at your finger tips. Marginal tax rate is your income tax bracket. For the bettors gambling winnings are taxable income like any other.

Guide to Manhasset 111320.

Virginia Gambling Winnings Tax Calculator Betvirginia Com

Alabama Gambling Winnings Tax Calculator Betalabama Com

How To File Taxes For Free In 2022 Money

Gambling Taxes How Does It Work And How Much Does It Cost

Nevada Income Tax Nv State Tax Calculator Community Tax

Calculating Taxes On Gambling Winnings In Pennsylvania

Excise Taxes Excise Tax Trends Tax Foundation

Tax Benefit Rule In Pa Vs The Federal Rule Macelree Harvey

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Lottery Calculator The Turbotax Blog

Tax Calculator Gambling Winnings Free To Use All States

Income Tax Calculator 2021 2022 Estimate Return Refund

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

Free Gambling Winnings Tax Calculator All 50 Us States

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

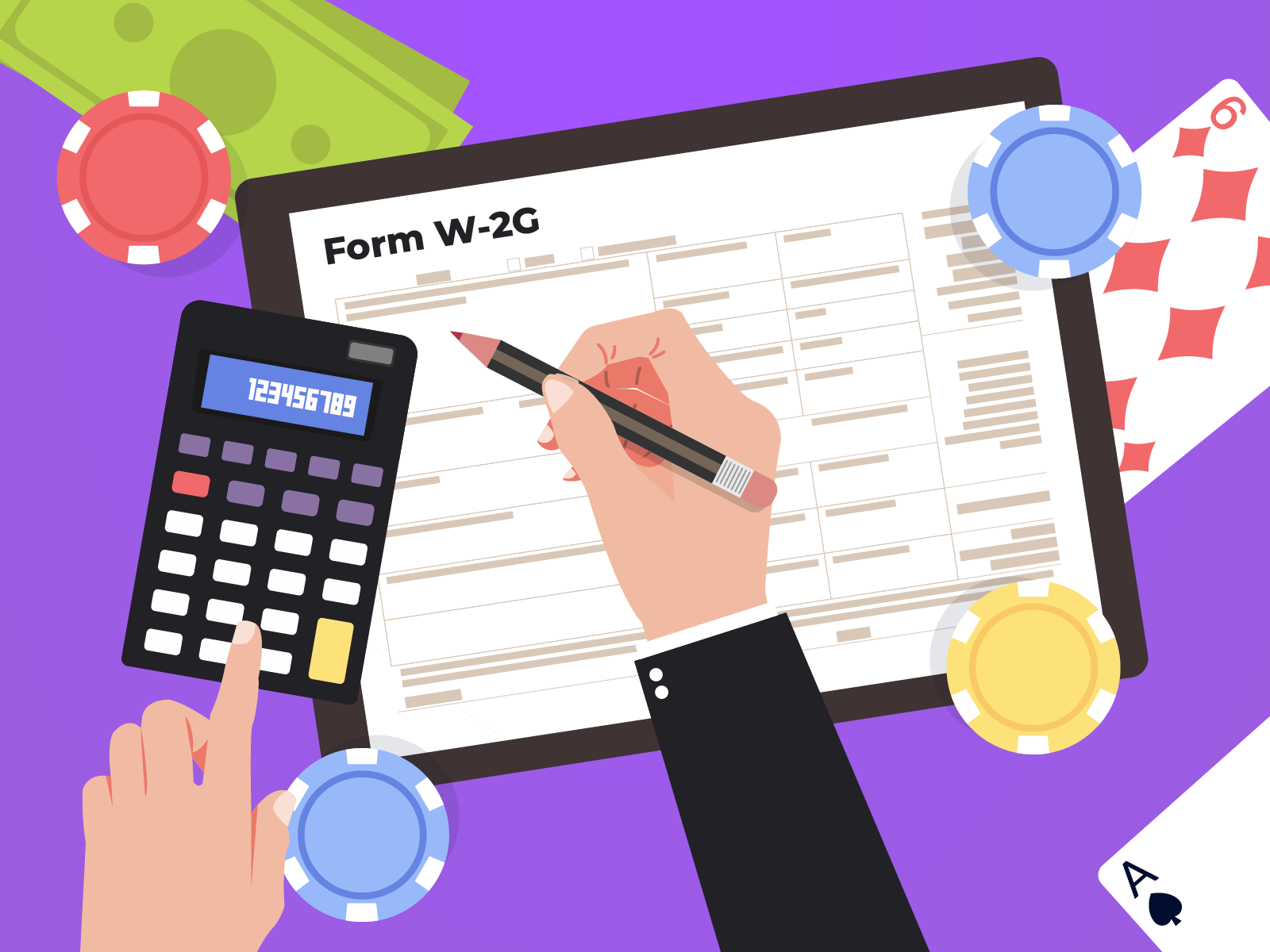

Form W 2g Certain Gambling Winnings Definition

Are Gambling Winnings Taxable Top Tax Tips Turbotax Tax Tips Videos

How To Pay Taxes On Sports Betting Winnings Losses

Do You Pay Taxes On Gambling Winning In Az Fullerton Financial